Ciao a tutti,

Spero che qualcuno qui abbia esperienza con le tasse svizzere e possa darmi qualche consiglio.

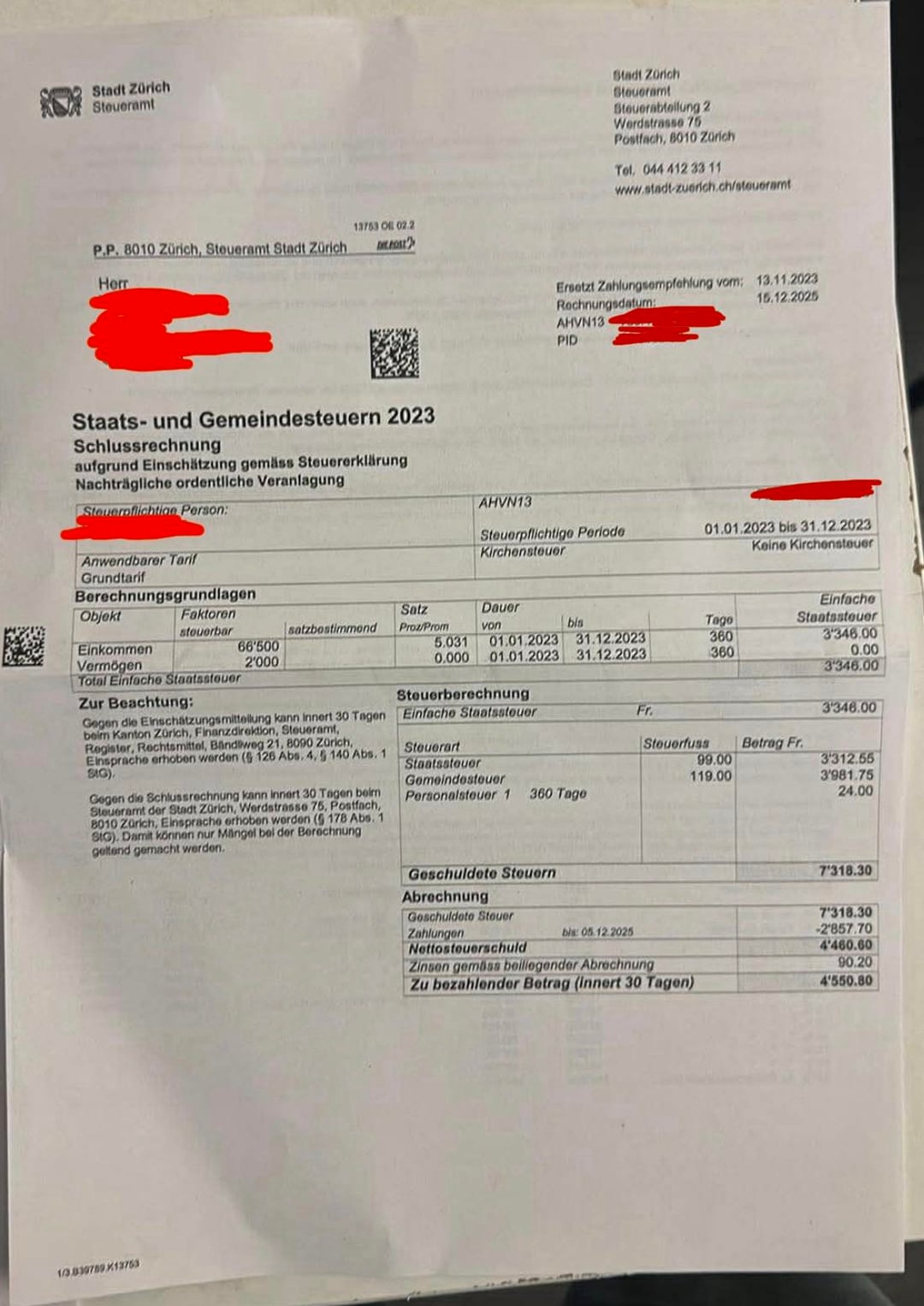

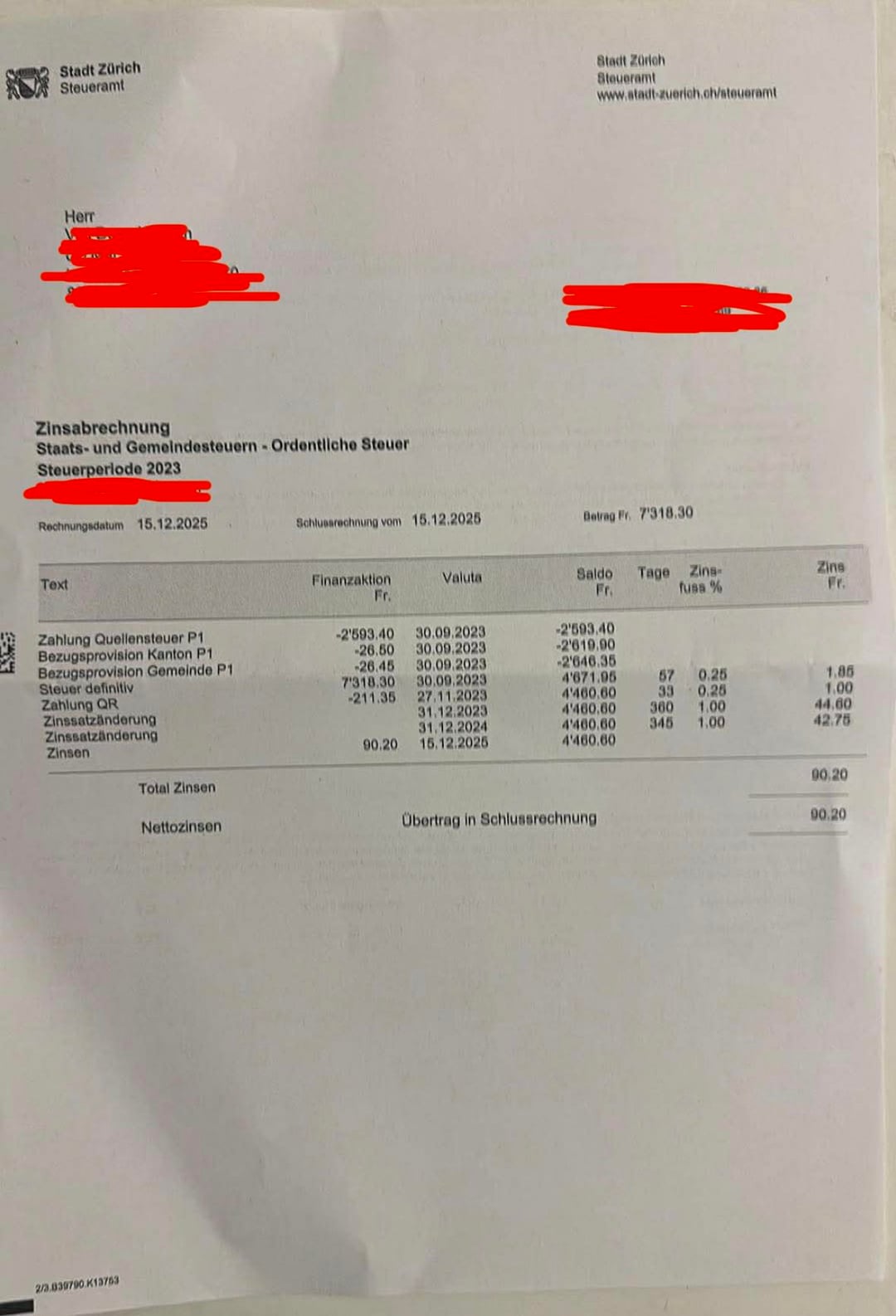

Recentemente ho ricevuto una lettera che mi chiedeva di pagare 4.500 franchi di tasse per l’anno 2023, cosa che mi ha davvero scioccato. La parte confusa è che: • Non vivo più in Svizzera e sono stato ufficialmente cancellato dalla registrazione dal luglio 2025 • La lettera è arrivata molto tardi, molto dopo l’anno 2023 • Lavoravo per una grande e consolidata azienda a Zurigo • Ogni mese ricevevo una busta paga che mostrava chiaramente lo stipendio lordo, le trattenute e lo stipendio netto • Avevo capito che tutte le tasse erano state correttamente trattenute alla fonte (Quellensteuer) dal mio datore di lavoro

Per questo motivo non capisco come ho potuto improvvisamente dover pagare una somma così grande.

Qualche giorno fa ho presentato un’opposizione scritta direttamente all’ufficio delle imposte. Quando ho parlato con un dipendente lì, mi ha detto: • Non sa quando avrò una risposta • La scadenza per il pagamento è un mese • Dovrei pagare prima e, se la mia obiezione viene accettata, il denaro mi verrà rimborsato in seguito

Onestamente, sono abbastanza preoccupato. 4.500 franchi sono un sacco di soldi e temo che, se pago adesso, il processo potrebbe trascinarsi per mesi (o più) e potrei non rivedere mai più i soldi, soprattutto perché credo sinceramente che questo importo non sia corretto.

Ho vissuto in Svizzera solo per pochi anni, quindi non ho molta familiarità con il sistema fiscale qui. Qualcuno ha vissuto qualcosa di simile, soprattutto dopo aver lasciato la Svizzera? È davvero normale pagare prima e risolvere poi?

Qualsiasi consiglio o intuizione sarebbe molto apprezzato. Grazie mille!

https://www.reddit.com/gallery/1pw18as

di moulaga77

18 commenti

Hehe. You will also get the Tax Bill for 2024 since you left only this year in 2025.

Pic 1 tells you everything you need to know. And yes, you have to pay taxes in Switzerland like everywhere else.

My assumption but not legal advice

If you worked in 2023 you have to pay income taxes for that year. The deductions were for AHV, BVG and accident insurance

you didnt submit your tax declaration for 2023, so they estimated your income instead. that always comes with a premium.

youll also receive a tax bill for 2024

Just commenting to give your post some visibility… hope someone can help you. But if you never got to the point of getting the C permit, I don’t see how can they double tax you. Better to get in contact with the Tax Office. Again, I’m not that long here so I don’t understand the system that well yet.

Looks like you are on Quellensteuern. Did you request a “Nachträgliche ordentliche Veranlagung” in 2024 (or any earlier)? If you did not, this looks very strange

Honestly not sure about the pay first / pay later. If you can I would go directly to the office with your Salary certificate for the year 2023 and let them sort it out.

Did you ever file taxes while living in Switzerland? This is not mandatory under B permit (except if you do it once you have to always do it for subsequent years or if you earn or have Vermögen above a certain threshold (the above is below it)). The quellensteuer already paid was properly accounted for (2.5k paid in first line on second picture). I am wondering if you maybe submitted a tax file in 2022 or before and therefore were required to filed one for 2023, didnt and then now you get the final tax bill for 2023 without much deduction since you dodnt file them yourself.

Did you file a tax return? Because the bill states that it is based on the filed tax return.

Often source tax is not enough to cover all of the tax liability, especially since the city has a high tax rate. Therefore you have an outstanding amount.

Super stupid question but how did you receive the letter? Your say you are deregistered? I am honestly not sure they can make you pay the bill, so maybe don‘t – at least until you figures out if it is right.

Edit: quite normal to receive a bill this late. There is a bit of a backlog apparently..😅

It looks like you lived also in Switzerland, right?

Denn you need to fillout the tax-report and send it to the government tax office. What you see on the loan-bill it’s an assumption and pre-cashing.

After the final tax calculation you‘ll receive a paper like that with either a Tax „Guthaben“ or „Schuld“.

Get a tax-office and let them do it for you. Cost about 200 Franks per year but it’s worth.

DM me for more info.

Call… them?

They are usally very nice and helpful.

Would be useful if you declared your situation like zipcode, marital status and age. IMO it’s very strange that the paid tax at source is so different from the actual tax calculated by authorities.

> My understanding was that all taxes were properly deducted at source (Quellensteuer) by my employer

1.) That’s not how it works in Switzerland. You have to pay individual tax.

2.) Why the tax bill only shows up now is a bit odd. When did you file the 2023 tax return?

3.) From when until when did you live in Switzerland? How much did you earn each year and did you fike a tax return?

4.) You left Switzerland this year. Unless you had a vastly different employment situation in 2024, you’ll likely also receive a bill there.

5.) Did you file your 2024 tax return? (Should’ve been done in 2025.)

Did you have a Quellensteuer deduction?

If you earn more than (I think) 120’k/y you still have to file a Steuererklärung. It looks like you did not and they assumed an amount (Einschätzung).

I would call them and see whats up – tell them you didn’t know and ask polity if they might still let you file. The rate in this case is higher (Einschätzung) and you could save a lot – had a similar situation in the past and it was almost 50% lower.

Just in case: This is for 2023 – if you left in July’25 you might still need to file for 2024 and 2025. Ask them about that as well if you already call.

No tax pro here but it seems you thought tax was covered by your employer. That’s false. Every swiss citizen has to pay tax according to how much they made, their wealth, everything. They take some time to come so I wouldn’t be surprised if one from 2024 is gonna show up too. Just pay it, you’re not getting scammed, just fullfilling all your financial obligations to your old country 🙂

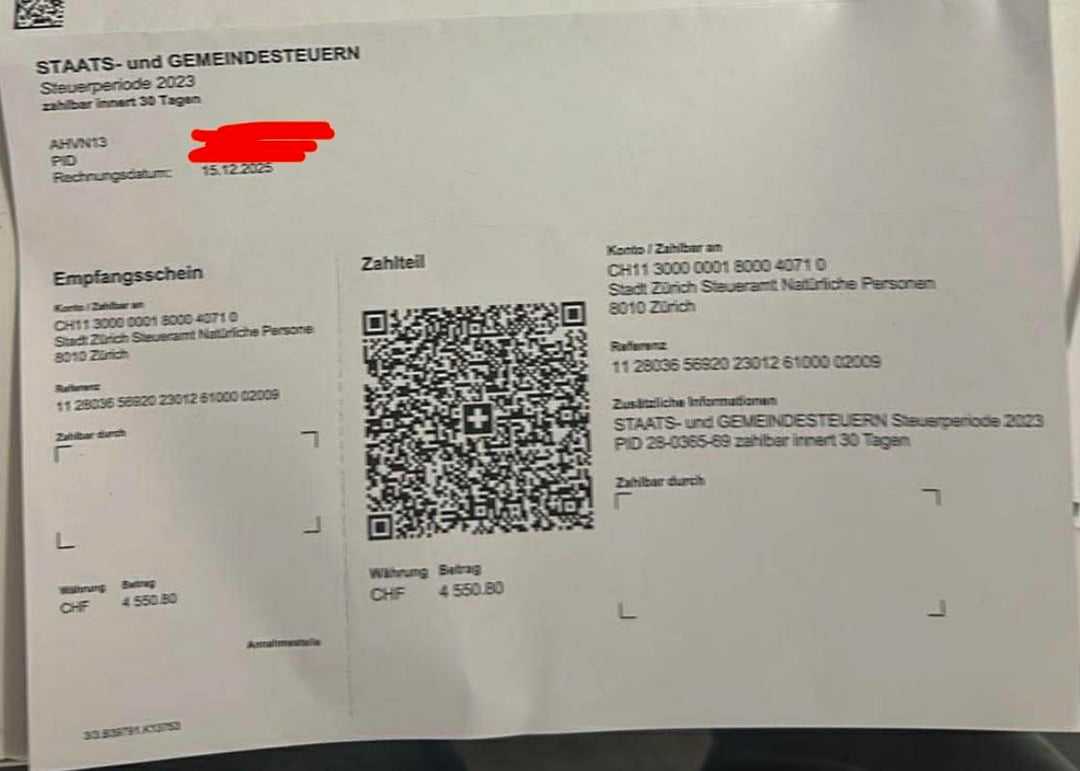

Nice of you to include the QR code, but I’m afraid I’m not gonna pay that tax bill for you.

Is it possible, that in 2023 your salary developed from BELOW 120K CHF to ABOVE 120k…??

Because if so, this would explain a lot.

“Is it really normal to pay first and sort it out later?”

This has been normal in all countries I have lived. First you have a tax estimate, and all the payments you do, including source tax, is actually just an estimate. Then later you file your taxes, the tax office calculates the final amount, and you get a refund or additional invoice. In Switzerland the tax office agas 5 years deadline to provide final calculation and invoice, which means you might get your invoice from 2025 as late as 2030.

From what I read you, had Quellensteuer.

So did you have work Permit B?

Did you earn under CHF 120k or over?

Contact also you’re companies HR, since they were in charge to ensure they submit everything correctly.