I servizi di pagamento europei (Bancomat, Bizum, Wero, MB Way, Vipps) stringono un’alleanza per ridurre la dipendenza dell’Europa dai fornitori di servizi di pagamento extraeuropei

https://epicompany.eu/media-insights/bancomat-bizum-epi-sibs-and-vipps-mobilepay-sign-mou-to-accelerate-the-rollout-of-sovereign-pan-european-payment-solutions

di CoffeeCakeAstronaut

5 commenti

>**What does it mean for European end-users and European merchants**

>European consumers will continue using their current preferred solution, now with broader European reach, benefiting from a user experience consistent with what they are accustomed to at home. Merchants will be able to accept payments from European consumers using a European solution, reducing dependency on international players. The solutions will develop a new branding badge next to their existing brands, enabling consumers to recognize where their preferred solutions will be accepted beyond current markets.

>**How the interoperability model will work**

>The cooperation is based on a central interoperability hub, operated by a future central entity jointly established by the partners.

>The central hub will act as a technical layer, enabling transactions to flow seamlessly between existing pan-european and national solutions, based on European standards and infrastructures, including instant account-to-account payments.

>Existing payment solutions will remain unchanged, preserving their brands, user experience and features.

Good news

Amazing, the technology to do things in Europe has always been there. It just had to give up the silly provincialism of having a service for each country.

Do you know what would be helpful?

If they all merge into one European champion, a European VISA/Mastercard.

But nooo, national governments need to hoard and pamper their national favourites!

We need European Fiscal Union, Banking Union, Savings Union, 28th regime and many other Federal level structures…yesterday.

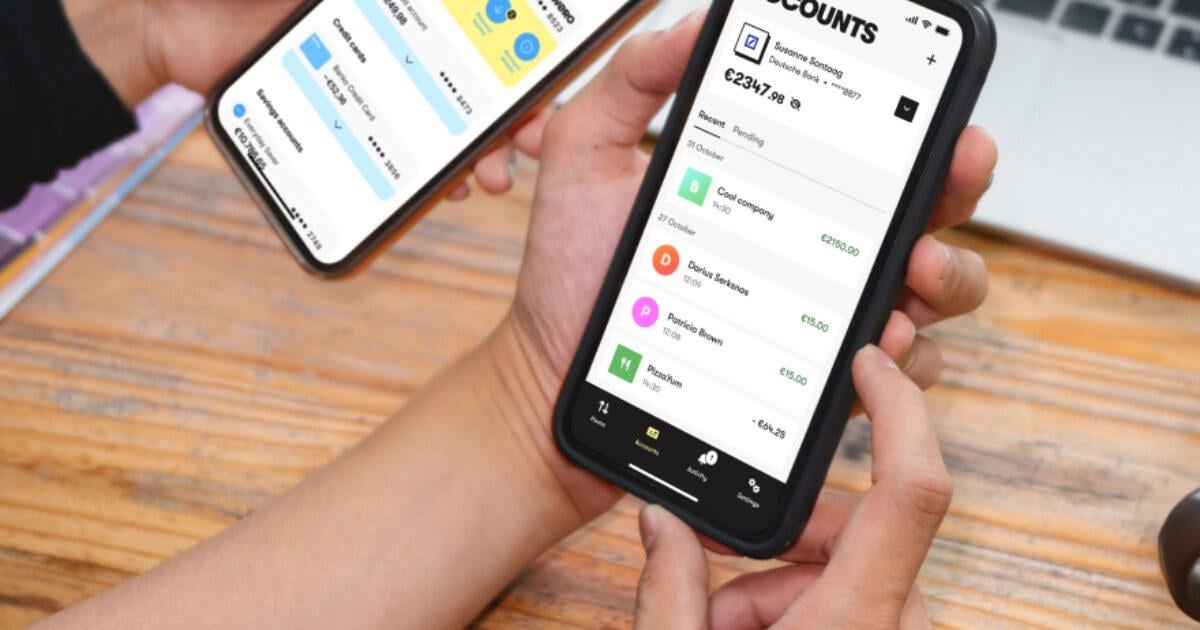

Meh, with SEPA Instant, I would honestly be fine with just an easier frontend that makes one tap and QR payments easier. My German Neobank already offers paymentink generation, QR code scan and payments (there is an EU standard), payment to contacts etc. Honestly that would enough for me to replace Paypal, if my friends weren’t too lazy to try new things out.

The main remaining benefit of sth like Paypal is additional customer protection, which afaik no EU alternative is willing to offer.

What I really can’t replace is my credit cards using US infrastructure providers.

European JCB when?